We all love theories. “Spend less than you earn,” “Save 20%,” “Budget your money.” Sounds great. But what does it look like in real life for a typical Indian family earning ₹40,000 in a metro?

Meet Rahul and Priya (names changed), a couple in Bangalore with a 4-year-old daughter. Rahul earns ₹40,000/month. Priya manages the home. This isn’t a theoretical exercise—this is their actual budget that helped them save, invest, and still live with dignity.

If you’ve ever thought “budgets don’t work in real India,” this post will change your mind.

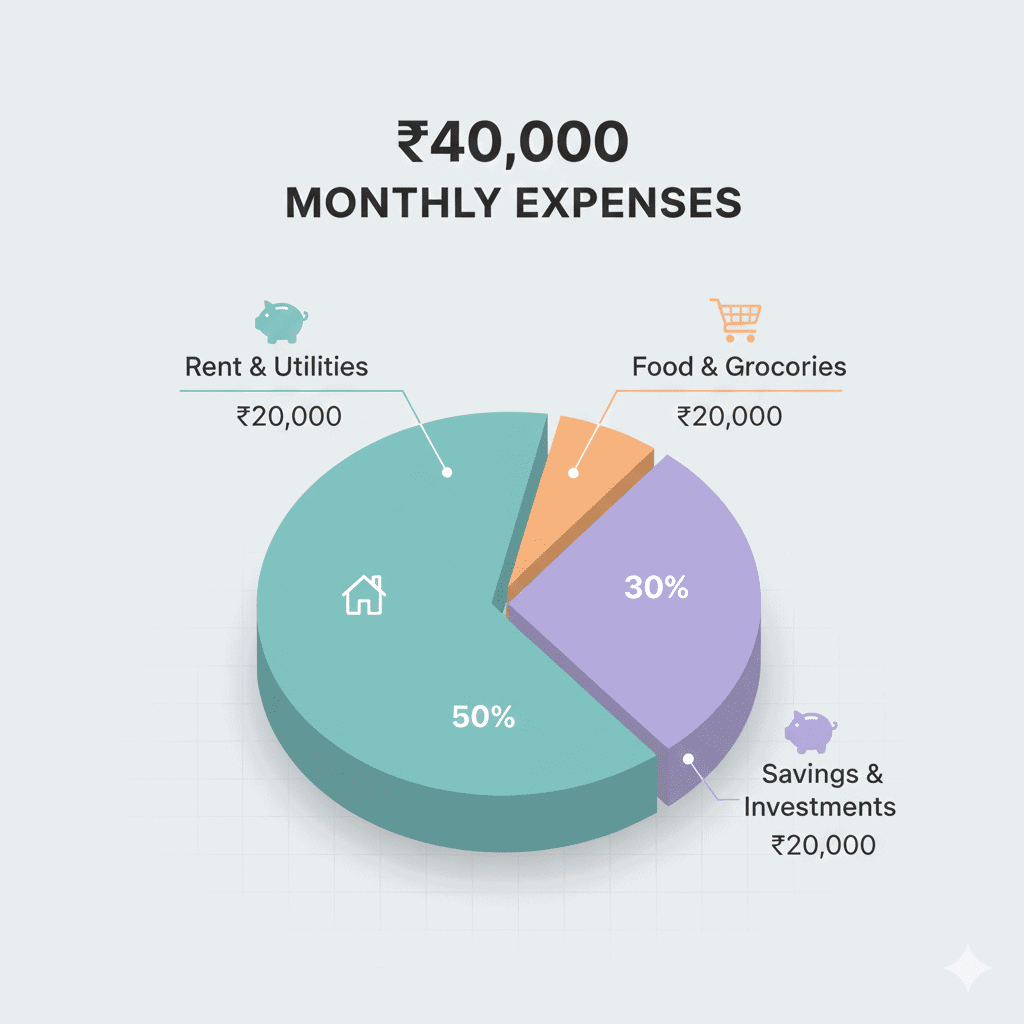

Part 1: The Raw Numbers – Where ₹40,000 Actually Goes

Monthly Take-Home: ₹36,200

(After PF, TDS—as we learned in our salary slip post!)

Using the 50/30/20 Rule:

- Needs (50%): ₹18,100

- Wants (30%): ₹10,860

- Future (20%): ₹7,240

Part 2: The “Needs” Bucket (₹18,100) – Non-Negotiables

| Expense | Amount (₹) | Notes |

|---|---|---|

| Rent | 9,000 | 1BHK in outskirts, 30km from office |

| Groceries | 5,000 | Monthly ration, vegetables, milk |

| Daughter’s School | 2,000 | CBSE school fees (monthly average) |

| Electricity/Water | 800 | With careful usage |

| Cooking Gas | 500 | One cylinder lasts 2+ months |

| Internet/Mobile | 800 | Basic plan for work + family |

| Total | ₹18,100 | Exactly 50% |

Reality Check: Notice—no car EMI, no eating out in “Needs.” Rent is kept at 25% of take-home (ideal). School fees hurt but are non-negotiable.

Part 3: The “Wants” Bucket (₹10,860) – Life’s Joys

| Expense | Amount (₹) | Philosophy |

|---|---|---|

| Eating Out | 1,500 | Twice a month at decent places |

| Entertainment | 1,000 | OTT subscriptions + occasional movies |

| Shopping | 2,000 | Clothes, household items (staggered) |

| Petrol | 2,360 | Office commute (30km daily on bike) |

| Weekend Outings | 1,000 | Park, mall visits with daughter |

| Gifts/Donations | 1,000 | Birthdays, festivals, temple |

| Miscellaneous | 2,000 | Medical, repairs, unexpected |

| Total | ₹10,860 | Used consciously |

Key Insight: They use the envelope system—₹10,860 cash withdrawn on 1st. When it’s gone, wants spending stops. No exceptions.

Part 4: The “Future” Bucket (₹7,240) – Building Tomorrow

| Investment | Amount (₹) | Purpose |

|---|---|---|

| Emergency Fund SIP | 3,000 | Liquid fund (building to ₹2 lakhs) |

| Daughter’s Education | 2,000 | Equity fund (18-year goal) |

| Retirement (NPS) | 1,000 | Extra beyond PF |

| Term Insurance | 540 | ₹1 crore cover (age 30) |

| Health Insurance | 700 | Top-up over company insurance |

| Total | ₹7,240 | Automated on 1st |

The Automation Magic:

All these are auto-debited on 2nd of month. Rahul never sees this money in his account. “Out of sight, out of mind, into future.”

Part 5: The Real-Life Challenges & Solutions

Challenge 1: “Unexpected Expenses Every Month!”

Solution: The ₹2,000 “Miscellaneous” in Wants covers 90% of surprises. For bigger ones, emergency fund (once built).

Challenge 2: “Festivals Destroy Our Budget!”

Solution: They save ₹500/month in a “Festival Fund” separate savings account. Diwali/Christmas comes from here, not regular budget.

Challenge 3: “Medical Emergencies?”

Solution: Company insurance (₹3 lakh) + top-up (₹10 lakh) + emergency fund building.

Challenge 4: “We Want a Vacation!”

Solution: ₹1,000/month in “Vacation Fund.” Every 2 years, they take a ₹24,000 trip.

Part 6: Their Monthly Money Ritual (You Can Copy)

Last Sunday of Every Month:

- Review: Check last month’s spending (using expense tracking app)

- Plan: Allocate next month’s buckets

- Withdraw: ₹10,860 cash for “Wants” envelope

- Automate: Ensure all SIPs/transfers are scheduled

- Celebrate: Small treat if they stayed on budget

Every 6 Months:

- Check insurance renewals

- Review investments

- Adjust for inflation (increase SIPs if salary increased)

Part 7: The 3-Year Transformation

This budget didn’t happen overnight. Three years ago:

- They had no emergency fund

- Lived paycheck to paycheck

- Had credit card debt

- No investments beyond PF

Today:

- Emergency fund: ₹1.2 lakhs (60% to target)

- Daughter’s education fund: ₹72,000 growing

- Zero debt except home loan planning

- Peace of mind: Priceless

Your Action Plan: Start Your ₹40,000 Budget

Week 1: The Numbers

- Calculate your exact take-home

- List your actual “Needs” (be ruthless)

- Allocate 50% to them

Week 2: The System

- Open 3 separate accounts: Needs, Wants, Future

- Set auto-transfers for Future bucket

- Withdraw Wants in cash

Week 3: The Tracking

- Use a simple notebook or Google Sheets

- Track every rupee spent

- No guilt—just observation

Week 4: The Review

- What went well?

- What needs adjustment?

- Increase one SIP by ₹100 next month

The Beautiful Truth About Budgets

A budget isn’t a restriction—it’s permission.

- Permission to spend on joy without guilt

- Permission to save for dreams without anxiety

- Permission to live today while building tomorrow

This completes our starter trilogy:

- Understanding your salary

- Building emergency safety

- Creating a working budget

What monthly income should we budget for next? Share in comments!

Leave a Reply