Whats in store for you?

Simple Money Tools for Indian Families

Plan, track, and understand your money using easy-to-use planners, trackers, and calculators — designed for Indian incomes.

- No investment advice.

- No sales calls.

- Just practical tools you control.

Welcome to Mera Money

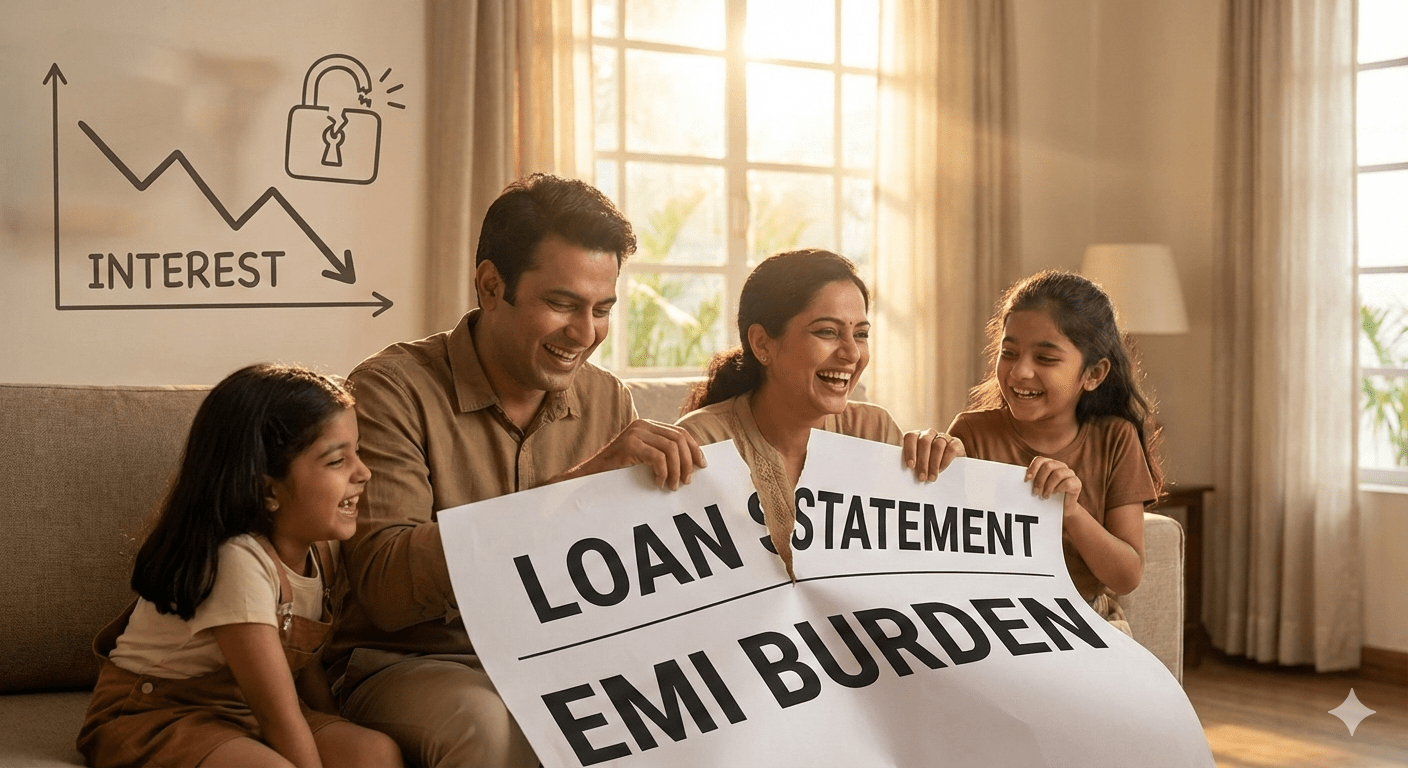

Managing money in India isn’t simple — EMIs, family responsibilities, rising costs, and confusing advice everywhere.

Mera Money helps you cut through the noise with:

- Simple financial education

- Practical DIY tools

- Zero pressure, zero advice

So you can make your own informed decisions, at your own pace.

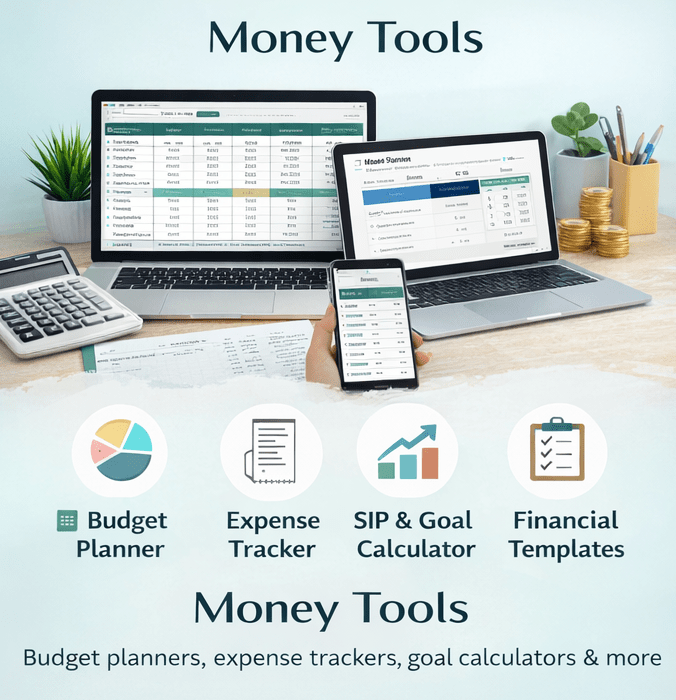

Money Tools You Can Actually Use

1

Budget Planner →

Plan monthly income, fixed expenses, savings & EMIs clearly.

2

SIP & Goal Calculator →

Estimate savings required for goals like retirement, education, or emergencies.

3

Financial Planning Templates →

Net-worth tracker, emergency fund planner, and more.

As seen on

Free Resources to Get You Started

1

Budget Starter Kit →

Simple monthly budgeting template

2

21 Smart Ways to Save →

Practical saving ideas that work in India

3

Debt-Free Roadmap →

A step-by-step plan to organize your loans

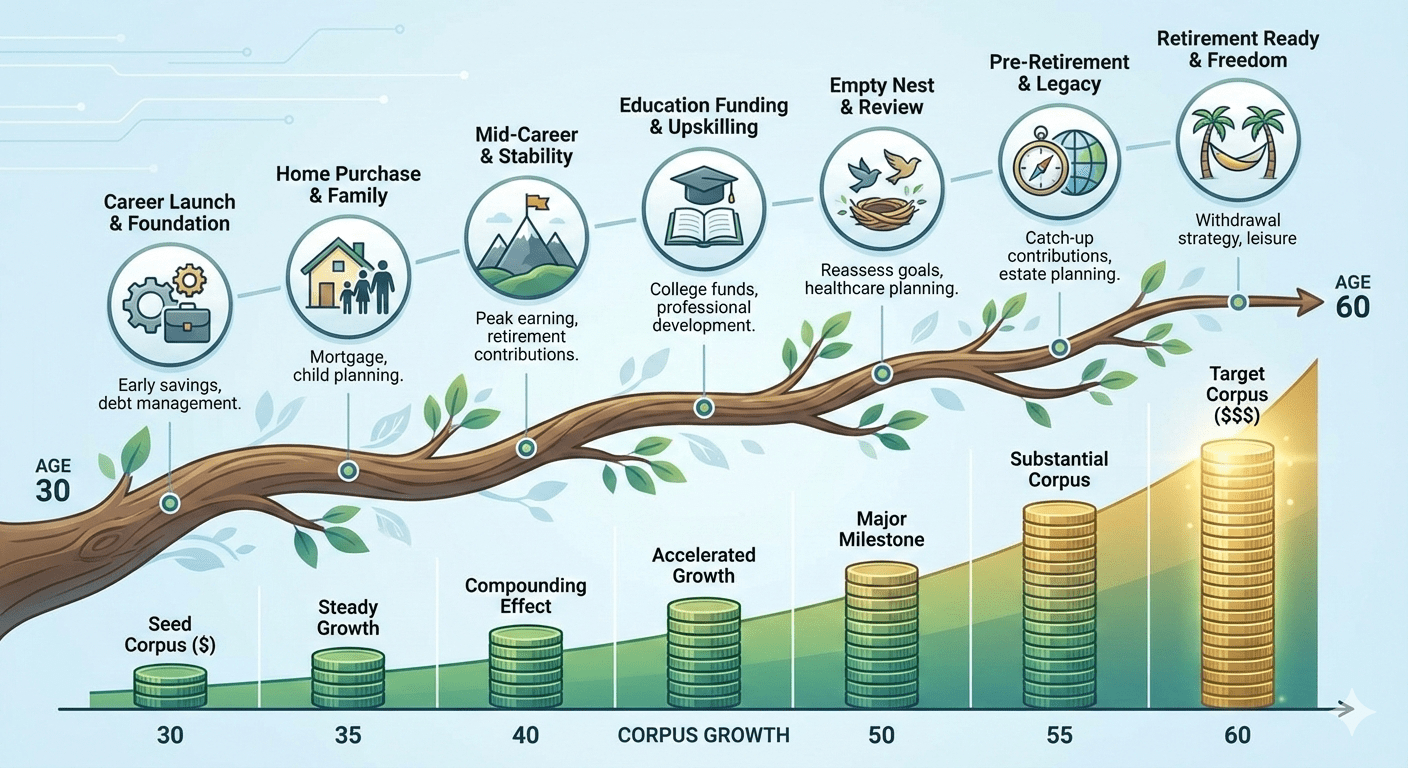

Learn Money Basics — Without Jargon

Our articles explain personal finance concepts using real Indian examples — salaries, EMIs, family goals, and everyday decisions. Read. Understand. Then use the tools to act.