That moment is here. The notification pops up. Your account balance just jumped. Your first real salary! The urge to celebrate, to buy that gadget, to treat your family—it’s all 100% valid. But what if you could do all that and set up a financial foundation that your 40-year-old self will thank you for?

Between the excitement and the “adulting” pressure, most first-salary stories go one of two ways: Spree & Regret or Paralysis & Confusion. Let’s choose a third path: Strategy & Freedom.

This isn’t about depriving yourself. It’s about empowering your money from Day 1. Let’s break down your first salary with a simple, legendary rule tailored for India.

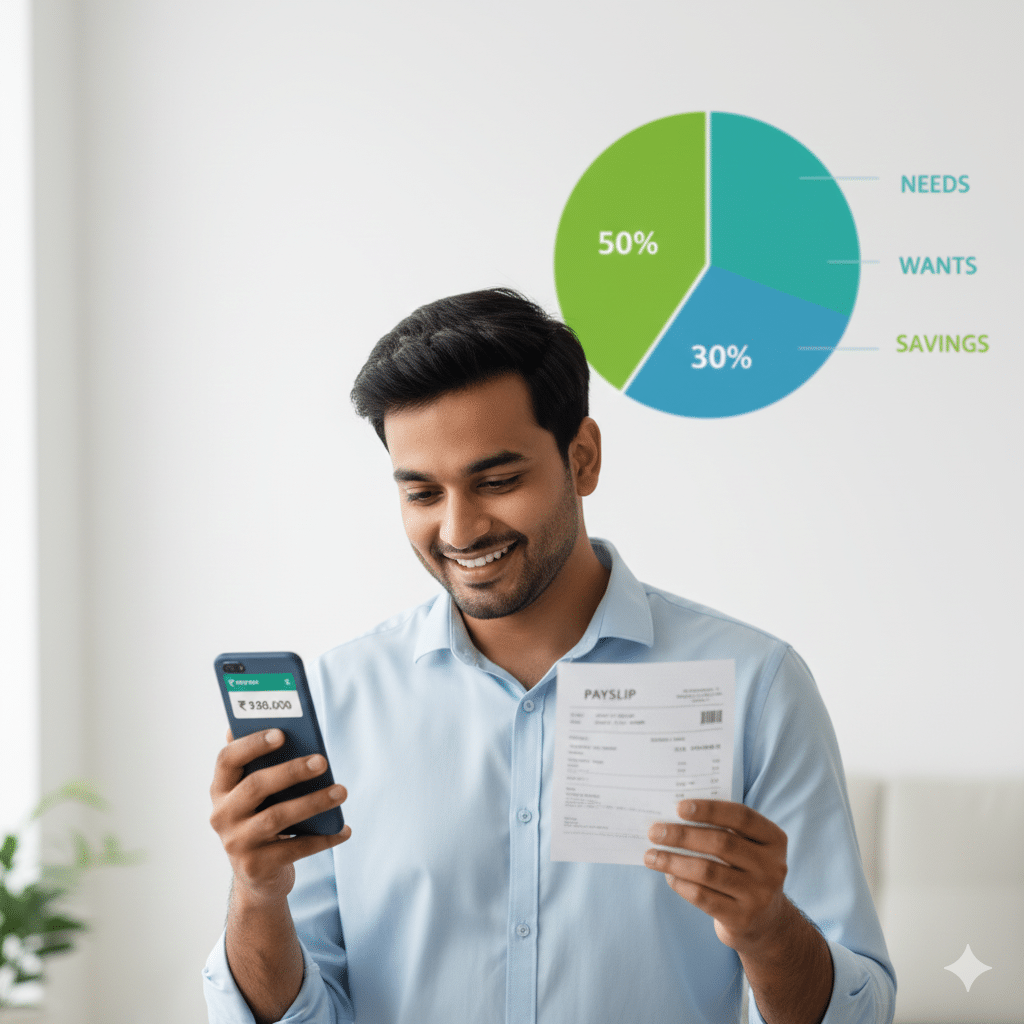

Forget Complex Budgets. Start With This One Rule: 50/30/20

Popularized by Senator Elizabeth Warren, this rule is the perfect starter framework. We’re going to Indianize it.

Here’s What It Means:

- 50% for Needs (Your Essentials)

- 30% for Wants (Your Lifestyle)

- 20% for Future You (Your Investments & Goals)

But here’s the Indian twist: We must account for family contributions, which are often a beautiful non-negotiable. Let’s build that in.

Step 1: The Non-Negotiables First (The 50% – Needs)

Don’t think of this as a restriction. Think of it as buying peace of mind. Your “Needs” are bills that, if unpaid, would disrupt your life.

Your Indianized Essentials Checklist:

- Rent & Utilities (If living away from home)

- Groceries & Daily Commute

- Internet & Mobile Recharge

- Family Support Contribution ✅

(Decide a fixed, comfortable amount for parents/siblings. It’s not an “expense,” it’s a value. Budgeting for it removes guilt and confusion.) - Basic Insurance Premiums (Start with at least a personal health insurance if not covered by employer)

- EMIs (if any existing loans)

Pro-Tip: If your essentials are less than 50%, fantastic! Redirect the surplus to “Future You” (Step 3).

Step 2: Guilt-Free Spending (The 30% – Wants)

This is your fun bucket. Yes, you MUST have this. Burning out with a miserable routine is not a financial strategy.

What fits here?

- Eating out, movies, weekends with friends

- That new pair of shoes, a gadget upgrade, hobby classes

- Spotify/Netflix subscriptions

- Travel & vacation fund

The Rule: Once this 30% is gone, your “wants” spending stops until next month. No dipping into other buckets. This teaches conscious spending.

Step 3: Building Your Future Self (The 20% – Future You)

This is the most important bucket. This money works silently so one day, you won’t have to.

Priority Order for Your “Future You” 20%:

- Emergency Fund First: Your financial shock absorber. Aim for 3-6 months of “Needs” (from Step 1). Park this in a Liquid Fund or a separate Savings Account. Don’t touch it.

- Skill Development Fund: Investing in yourself gives the highest returns. Allocate for courses, certifications, or books that boost your career.

- Begin Investing: Start small, but start now. Refer to our guide on Your First ₹1000: Where to Start Investing.

- Start a SIP in a Nifty 50 Index Fund (₹500-1000/month).

- If you have no insurance from your employer, get a Term Insurance Plan (it’s dirt cheap when you’re young).

- Long-Term Goals: Dreaming of a master’s degree in 3 years? A car down payment? Start a separate Recurring Deposit (RD) or Debt Fund SIP for each goal.

Your First Salary Action Plan: A Weekend Task

Task 1: The Number Ceremony

- Open a spreadsheet or notepad.

- Write down your Net Salary (in-hand amount).

- Now, apply the 50/30/20 rule to get your three buckets.

Example for ₹40,000 In-hand Salary:

- Needs (50%): ₹20,000

- Wants (30%): ₹12,000

- Future You (20%): ₹8,000

Task 2: The Account Setup (The “Automation Hack”)

This is the game-changer. Set up automatic transfers on the 1st of every month.

- Needs Account: Your main salary account. All bills auto-debit from here.

- Wants Account: Open a separate digital bank account (like Kotak 811, Fi, Jupiter). Auto-transfer ₹12,000 here. Spend only from this account for fun.

- Future Account: Open a third account (or use your main investment app). Auto-transfer ₹8,000 here. This is not for spending, only for growing.

Task 3: The First “Future You” Transfer

This weekend, from your “Future” bucket:

- Start an Emergency Fund RD of ₹3,000/month.

- Start a SIP in an Index Fund of ₹1,000/month.

- Bookmark ₹1,000 for a skill-enhancing course.

- Use the remaining ₹3,000 to pay for a basic health plan if needed.

The 3 Big First-Salary Mistakes to Avoid:

- The Lifestyle Inflation Trap: Upgrading your apartment, car, and lifestyle the moment your salary upgrades. Delay gratification. Let your investments grow first.

- Ignoring Free Money: If your employer offers PF contribution or Group Health Insurance, maximize it. It’s part of your compensation.

- No Emergency Fund: Living salary-to-salary is incredibly stressful. Your emergency fund is your ticket to sleeping peacefully.

The Mindset Shift: You’re Not Just Earning, You’re Building

Your first salary isn’t just income; it’s your first resource allocation exercise. You are the CEO of Your Life Inc. You’re now in charge of the R&D (Skill Development), Operations (Needs), Marketing (Wants), and most importantly, the Future Expansion Fund.

Celebrate this milestone. Take your parents out to dinner. Buy yourself something nice. You’ve earned it. Then, sit down for one hour this weekend and set up these three simple buckets.

The compound effect doesn’t just work on money. It works on habits. The habit of smart allocation you build today will pay dividends for decades.

What’s Next? In our upcoming post, we’ll tackle “Demystifying Your Salary Slip: Decoding PF, Gratuity, and Tax Deductions.” You’ll finally understand where your money is going before it even hits your account.

Got your first salary story or a question? Share in the comments below! Let’s build a community of smart starters.

P.S. This is the beginning of a powerful series. Bookmark this post and come back to it when you get a raise or a bonus. The percentages can scale with your income!

P.P.S. Loved this actionable plan? Share it with that friend who just landed their first job. The best financial gift you can give is the right start.

Leave a Reply