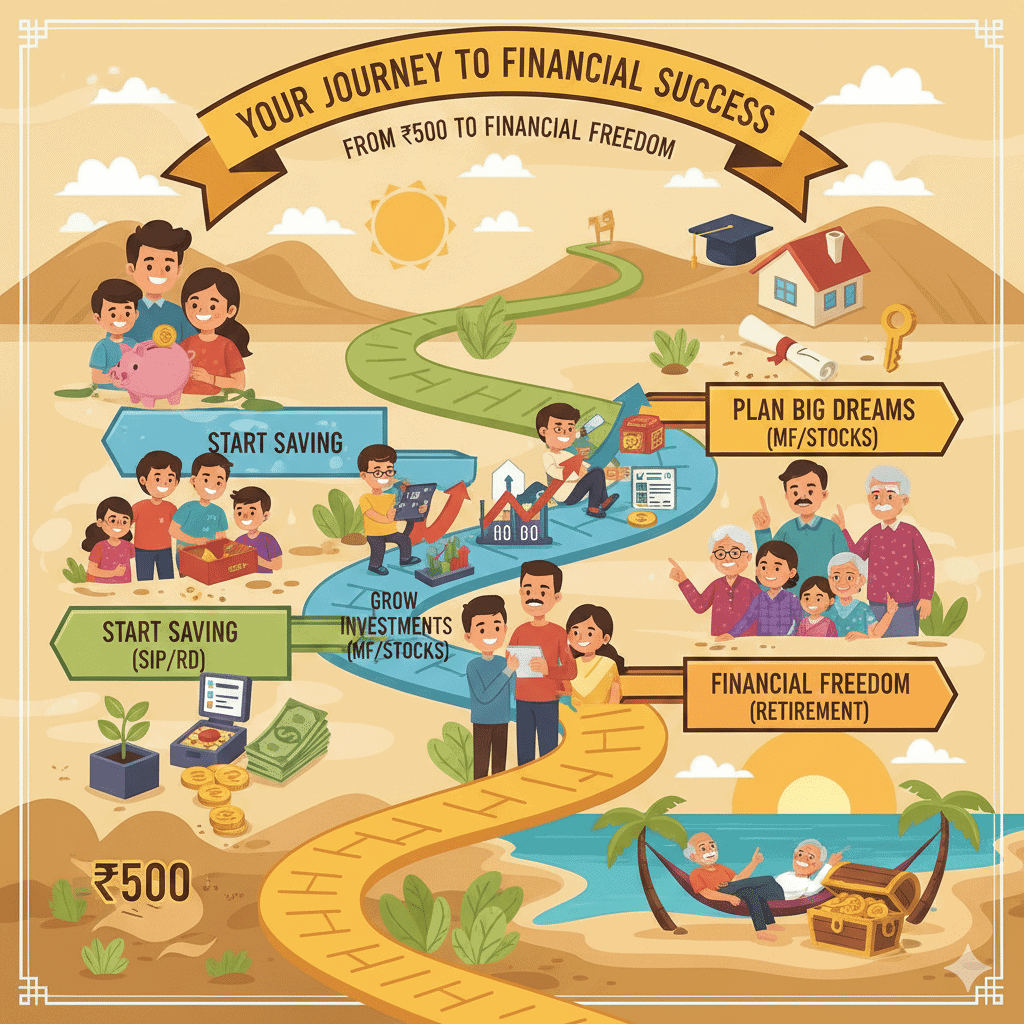

Start with ₹500 | No Prior Knowledge Needed | Middle-Class Friendly

1. Why Every Indian Must Invest: The Mindset Shift {#mindset}

The Inflation Monster is Eating Your Savings

Fact: If your savings earn 4% (in savings account) and inflation is 6%, you’re losing 2% every year. ₹1 lakh today will be worth only ₹74,000 in 5 years in purchasing power.

Three Types of People in India:

- The Saver: Keeps money in FD/Savings (Loses to inflation)

- The Speculator: Trades stocks/bitcoin (90% lose money)

- The Investor: Invests systematically (Builds real wealth)

Which one are you? This guide helps you become The Investor.

The Power of Starting Early:

*A 25-year-old investing ₹5,000/month at 12% = ₹3.4 crore at 60*

*A 35-year-old starting same = ₹1.1 crore at 60*

*10 years delay = ₹2.3 crore less*

You don’t need to be rich. You need to be consistent.

2. The Indian Investment Pyramid: What to Do FIRST {#pyramid}

Layer 1: Foundation (Month 1-3)

Emergency Fund: 6 months of essential expenses in liquid mutual fund

Health Insurance: Minimum ₹5 lakh cover (Ayushman Bharat + top-up)

Term Insurance: If you have dependents, ₹1 crore cover (costs ₹500-1000/month)

Layer 2: Core Investments (Month 4-24)

PPF: ₹500/month for retirement safety

ELSS: Tax saving + growth (₹500/month minimum)

Index Fund SIP: ₹1000/month for long-term wealth

Debt Fund: For goals 3-5 years away

Layer 3: Advanced (Year 3+)

Direct Stocks: Only if you enjoy researching companies

Real Estate (REITs): Start with ₹10,000 in REIT mutual funds

International Funds: 10-20% portfolio for diversification

3. Your First ₹500: Where It Actually Goes {#first500}

Scenario Analysis:

If you invest ₹500/month for 30 years at 12%:

- Total Invested: ₹1,80,000

- Final Value: ₹17,60,000

- Growth: ₹15,80,000 (That’s your money working for you!)

Where Should Your First ₹500 Go?

- Emergency Fund Building (Months 1-6): Liquid fund SIP

- After Emergency Fund: Split ₹500 as:

- ₹300 in Index Fund SIP

- ₹200 in PPF (through monthly RD, yearly transfer)

The “Pizza Rule”:

“Every time you order a ₹500 pizza, invest ₹50 first. In 20 years, that pizza money could buy you a car.”

4. Understanding Your Risk Appetite: Simple 3-Question Test {#risk}

Question 1: If your investment falls 20% in 3 months, you:

A) Panic and withdraw everything (Low Risk)

B) Worry but hold (Medium Risk)

C) See it as buying opportunity (High Risk)

Question 2: Your investment time horizon:

A) 1-3 years (Low Risk)

B) 3-7 years (Medium Risk)

C) 7+ years (High Risk)

Question 3: Your primary goal:

A) Don’t lose money (Low Risk)

B) Beat FD returns (Medium Risk)

C) Build significant wealth (High Risk)

Most Indians Score: Medium Risk (B-B-B). This means:

- 60% in equity (stocks/mutual funds)

- 30% in debt (FDs, bonds)

- 10% in gold

5. The Big 6 Investment Options Explained {#options}

COMPARISON TABLE:

| Investment | Min Amount | Lock-in | Expected Return | Risk | Best For | How to Start |

|---|---|---|---|---|---|---|

| PPF | ₹500/year | 15 years | 7-8% | Very Low | Retirement, child future | Post office/bank |

| Nifty Index Fund | ₹100/month | None | 10-12% | Medium | Long-term wealth | Groww/Zerodha app |

| ELSS | ₹500/month | 3 years | 10-12% | Medium | Tax saving + growth | Mutual fund app |

| Senior Citizen FD | ₹1000 | 5 years | 7-8% | Very Low | Retired parents | Bank |

| Sovereign Gold Bond | 1 gram | 8 years | Gold+2.5% | Low | Diversification | Demat account |

| NPS | ₹500/month | Till 60 | 8-10% | Medium | Extra retirement | Bank/NPS portal |

Detailed Breakdown:

1. Public Provident Fund (PPF) – Your Retirement Anchor

What: Government-backed, tax-free returns

Why: Guaranteed returns, tax benefits (EEE)

Ideal for: Risk-averse beginners, retirement corpus

Start with: ₹500/month through RD, transfer yearly

Pro Tip: Open for your child too – 15-year compounding is magical

2. Nifty 50 Index Fund – The “Bet on India” Fund

What: Invests in India’s top 50 companies automatically

Why: Low cost (0.1% vs 1-2% for active funds), beats most fund managers

Returns: Historical 12-14% over 10+ years

Start: ₹500 SIP on Groww/Zerodha

Mindset: “I believe India will grow in next 20 years”

3. ELSS – Tax Saving That Actually Grows

Tax Benefit: ₹1.5 lakh under Section 80C

Lock-in: 3 years (shortest among 80C options)

Risk: Medium (invests in stocks)

Best Funds: Axis, Mirae Asset, Quant

Strategy: Start SIP in November to average costs

4. Gold – But The Smart Way

Avoid: Physical gold (making charges, safety issues)

Choose: Sovereign Gold Bonds (SGBs)

Benefits: 2.5% extra interest, tax-free if held 8 years

Allocation: 5-10% of portfolio

When to Buy: Diwali/fall season (traditional, plus bonus)

5. NPS – Extra Retirement Boost

For: Salaried employees wanting more than PF

Tax Benefit: Extra ₹50,000 under 80CCD(1B)

Flexibility: Choose equity/debt mix

Withdrawal: 60% tax-free at 60

Start: Tier 1 account via bank

6. Debt Mutual Funds – For Short-Term Goals

When: Goals 1-5 years away (car, vacation, house down payment)

Better than FD: More tax-efficient for 3+ years

Types: Liquid (emergency), Ultra Short-term (1-3 years)

Returns: 6-7% with low risk

6. Common Beginner Mistakes & How to Avoid Them {#mistakes}

Mistake 1: Waiting for “Perfect Time” to Start

Reality: The best time was yesterday. Second best is today.

Solution: Start ₹100 SIP TODAY. Increase later.

Mistake 2: Chasing Past Performance

Example: “This fund gave 50% last year, I’ll invest”

Reality: Past ≠ Future. Top performers often become laggards.

Solution: Choose index funds or consistent performers.

Mistake 3: Too Many Small Investments

Problem: ₹1000 in 10 different funds = ₹10,000 but messy

Solution: 3-4 funds maximum:

- Nifty Index Fund

- ELSS (for tax)

- PPF (for safety)

- Debt fund (for goals)

Mistake 4: Ignoring Insurance

Story: Ramesh, 35, invested ₹20 lakhs. Heart attack – medical bill ₹15 lakhs. Portfolio destroyed.

Solution: Health insurance FIRST, then investments.

Mistake 5: Checking Portfolio Daily

Psychology: Daily fluctuations cause panic

Rule: Check quarterly. Review annually.

Analogy: Don’t dig up a seed daily to check growth.

7. Your 12-Month Action Plan {#action}

Month 1-3: The Foundation

- Week 1: Calculate emergency fund need (6 × monthly expenses)

- Week 2: Open liquid fund SIP for emergency fund

- Week 3: Buy term insurance (if have dependents)

- Week 4: Buy health insurance (if not from employer)

Month 4-6: First Investments

- Start ₹500 SIP in Nifty Index Fund

- Open PPF account (₹500 deposit)

- Create “Goals Sheet” (Car, house, education, retirement)

Month 7-9: Tax Planning

- Start ₹500 ELSS SIP for tax saving

- Submit investment proofs to employer

- Plan next year’s tax-saving investments

Month 10-12: Review & Scale

- Review all investments

- Increase one SIP by 10%

- Add gold (SGB) if needed

- Plan next year’s goals

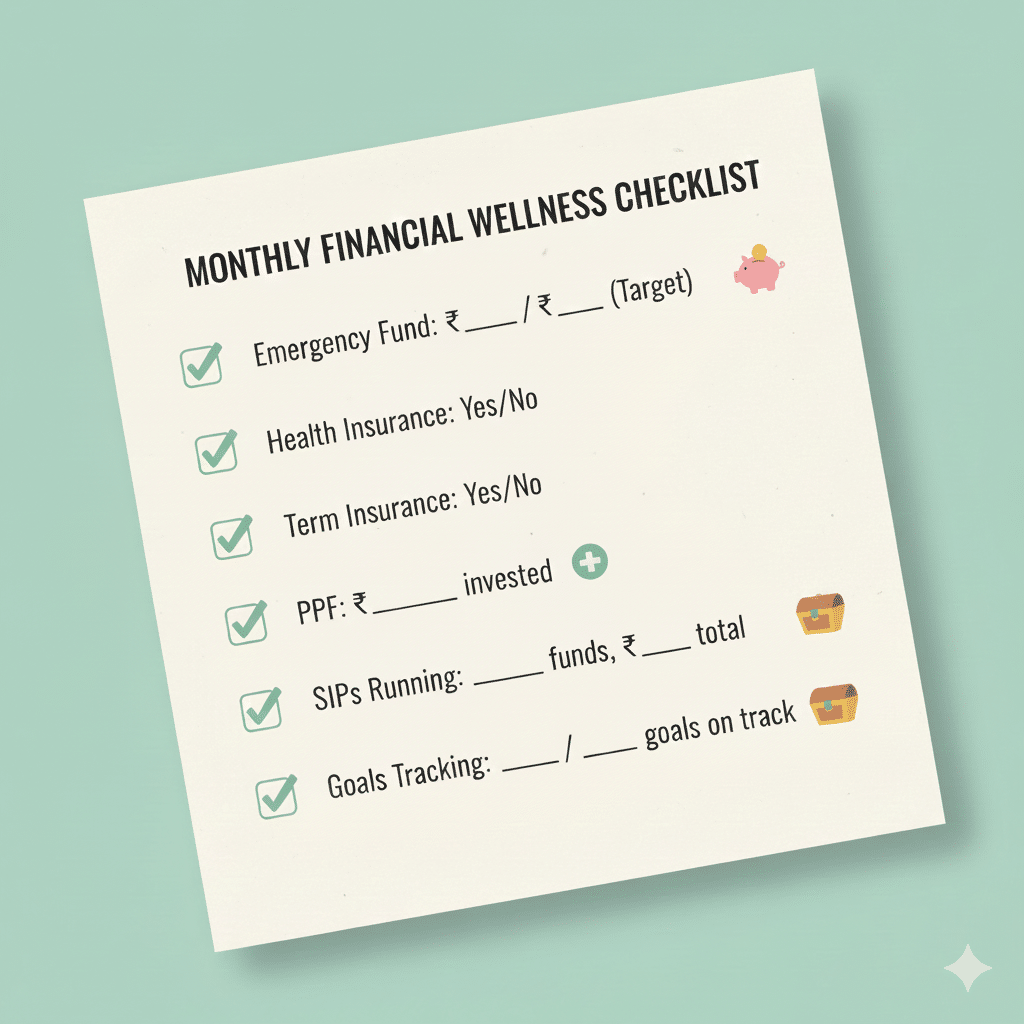

Monthly Habit Tracker:

8. FAQs: Real Questions from Beginners {#faq}

Q1: “I’m 40. Is it too late to start?“

A: The best time was earlier. Second best is today. At 40, focus on:

Aggressive debt funds (60%)

Equity funds (40%)

Higher monthly investment

Delay retirement by 2-3 years if neededQ2: “What if I need money suddenly?“

A: That’s why Layer 1 (emergency fund) exists. Don’t invest money needed in 1-3 years. Keep in liquid/debt funds.

Q3: “How do I choose between so many mutual funds?”

A: Start with:

One Nifty 50 Index Fund

One ELSS fund (for tax)

One liquid fund (emergency)

That’s enough for first 2 years.Q4: “Should I invest during market highs?”

A: Yes, through SIP. SIP removes timing risk. Continue during highs and lows.

Q5: “How much return to expect realistically?”

A: After inflation (6%):

Equity: 4-6% real returns

Debt: 1-2% real returns

Gold: 1-3% real returns

Real returns = Nominal returns – InflationQ6: “What about cryptocurrency?”

A: For beginners: Avoid or allocate maximum 1-2% of portfolio as “learning money.” Consider it entertainment budget, not investment.

Q7: “My friend makes money trading. Should I?”

A: Ask to see 3-year portfolio statement, not screenshots. 90% lose money trading. Learn investing first. Paper trade for 6 months if curious.

Q8: “How much should I invest monthly?”

A: Start with whatever you can:

₹500 if that’s all you have

Ideal: 20% of take-home salary

Maximum: 50% if living with parents and no responsibilities

📚 Recommended Next Reads:

- Salary Slip Decoded: PF, TDS, HRA Explained

- Emergency Fund: How to Save 6 Months of Expenses

- SIP vs Lumpsum: Which is Better for You?

- Real ₹40,000 Budget: A Middle-Class Case Study

🎯 Final Checklist Before You Start:

Week 1 Tasks:

- Calculate emergency fund target

- Open liquid fund SIP (even ₹1000/month)

- Review insurance coverage

Month 1 Tasks:

- Start one SIP (Nifty Index Fund, ₹500)

- Open PPF account (₹500 deposit)

- Set up auto-debit for all investments

Quarter 1 Review:

- Emergency fund progress

- SIP consistency

- Insurance in place

- Learning: Read one finance book/article weekly

🌟 Remember These Truths:

- You don’t need to be an expert – Just consistent

- ₹500 today > ₹1000 tomorrow – Time is your biggest asset

- Mistakes will happen – Learn, don’t quit

- Compare with yourself yesterday – Not with neighbor’s car

- Financial peace > Fancy lifestyle – Sleep well at night

🚀 Your Journey Starts Now:

Today: Bookmark this page

This Week: Start ₹500 SIP (any fund)

This Month: Build emergency fund

This Year: Become a confident investor

Share your starting story in comments below! What’s your first investment going to be? Let’s build this community together.

📞 Need Personalized Help?

While I can’t give individual advice (I’m not SEBI registered), our community in comments can share experiences. For complex situations, consult a fee-only financial planner (not commission-based).

Last Updated: Dec 2025

Next Review: Feb 2026 (Tax changes, new rules)

Share This Guide: Help a friend start their journey!

Leave a Reply