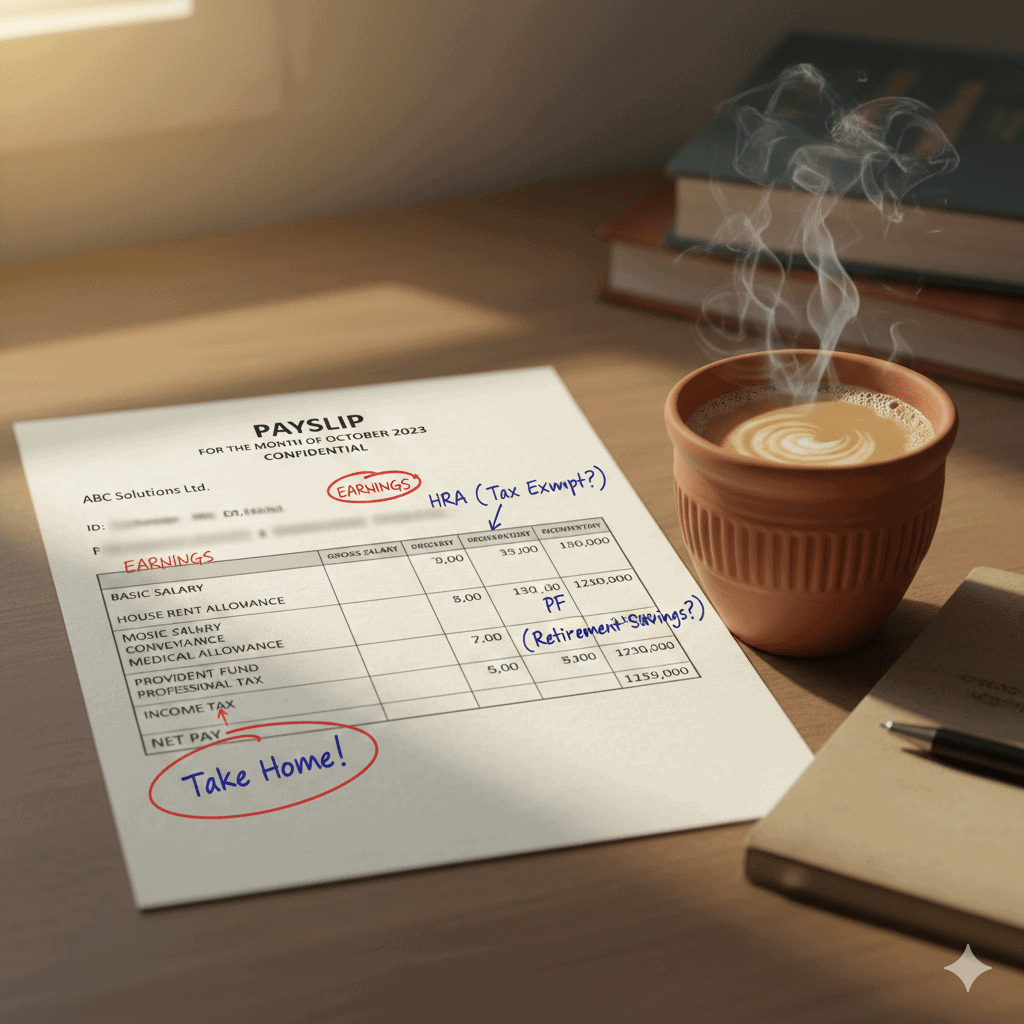

That confusing piece of paper holds the key to planning your money better. Let’s break it down, line by line.

You open your email, see the salary slip attachment, glance at the “Net Pay” number, and close it. That slip goes into a digital folder named “Tax” that you’ll dread opening next July. Sound familiar?

What if I told you that slip isn’t just a receipt—it’s a financial health report card? Every deduction has a purpose, every component is money either saved for you or planned for your future. Understanding it is the first step to claiming control over your earnings.

Grab your latest salary slip and a cup of hot chai. Let’s walk through it together, line by line. No jargon, just clarity.

Part 1: The Two Big Numbers Everyone Checks (And Often Misunderstands)

Gross Salary ≠ What You Deserve

Gross Salary is your total cost to the company (CTC) before any cuts. It’s like the MRP on a product—you never actually get that full amount.

Net Salary ≠ What You Can Spend Freely

Net Salary (Take-Home) is what hits your bank account after ALL deductions. But wait—don’t budget with this number yet. Some deductions are actually your money, saved for you.

Part 2: The “Golden Deductions” – Your Money, Saved for YOU

These aren’t expenses. They’re forced savings that will benefit Future You. This is the most important mindset shift.

1. Provident Fund (PF) – Your Retirement Rock

- What it is: A mandatory retirement savings scheme where both you and your employer contribute 12% each of your Basic + DA.

- Your Contribution (12%): Goes from your salary into your PF account. You feel this as a deduction.

- Employer’s Contribution (12%): FREE MONEY. The company adds this on top of your salary. You don’t see it in-hand, but it’s yours.

- Why it’s gold:

- Earns tax-free, guaranteed interest (~8% currently)

- Withdrawable for emergencies (house construction, marriage, medical)

- The foundation of your retirement corpus

- Action Check: Ensure your PF is being deducted! It’s non-negotiable for long-term security.

2. Gratuity – Your Loyalty Bonus

- What it is: A lump sum paid by your employer when you leave after 5+ years of service.

- Formula: (Last drawn salary × 15/26) × Number of years of service

- Example: If your last basic is ₹50,000 and you worked 5 years:

(50,000 × 15/26) × 5 = ≈₹1.44 lakhs (tax-free!) - Mindset Shift: Not a deduction, but a future benefit that accrues yearly.

Part 3: The “Tax & Insurance” Shield – Protecting Your Income

1. Professional Tax (PT)

- What: A small state tax (₹200-₹300/month) on your employment. Maximum ₹2,500/year.

- Good news: Deductible from your income tax calculation.

2. TDS (Tax Deducted at Source)

- What: Your company pays your income tax in advance to the government on your behalf.

- Based on: Your declared investments (HRA, LTA, 80C, 80D, etc.) in your Investment Declaration submitted at year-start.

- Crucial: If you didn’t submit proofs or declared wrong, you’ll pay extra tax while filing ITR. Submit those rent receipts and insurance proofs!

3. Employee State Insurance (ESI) & Health Insurance

- ESI: For lower salary brackets (< ₹21,000). Covers medical needs for you and family.

- Group Health Insurance: Provided by your company. Note the sum insured and check if you need a top-up.

Part 4: The Allowances – Your Flexible Friends

1. House Rent Allowance (HRA) – The Tax Saver

- What: Partial reimbursement of your rent.

- Tax Exemption: Minimum of these three:

- Actual HRA received

- 50% of Basic (Metro) / 40% (Non-Metro)

- Actual rent paid minus 10% of Basic

- Action Item: Submit rent receipts to HR to claim this exemption. Don’t leave this money on the table!

2. Leave Travel Allowance (LTA)

- What: Reimbursement for travel expenses during leave.

- Catch: Only for travel costs (not hotel/food). Can claim twice in a block of 4 years.

- Pro Tip: Plan a family trip and claim it. It’s tax-free money.

3. Special Allowances

- Food Coupons: Up to ₹2,600/month tax-free. Use them!

- Transport Allowance: Fixed amount for commute (partially exempt).

- Internet/Phone Reimbursement: Submit bills and get tax-free.

Part 5: Your Salary Slip Walkthrough – A Real Example

Let’s decode a ₹40,000 CTC salary slip (simplified):

| Component | Amount (₹) | What It Means For You |

|---|---|---|

| Basic + DA | 20,000 | PF & Gratuity base. Higher basic = better long-term benefits. |

| HRA | 8,000 | Submit rent receipts! Save tax. |

| Special Allowance | 12,000 | Flexible part of your pay. |

| Gross Salary | 40,000 | Your CTC before cuts |

| PF (Your 12%) | -2,400 | Your money, saved for you at 8% interest. |

| TDS | -1,200 | Advance tax. Adjust with investment proofs. |

| Professional Tax | -200 | Small state tax. |

| Total Deductions | -3,800 | Not lost, just allocated |

| Net Salary (Bank) | 36,200 | What you see in account |

| Employer’s PF (12%) | +2,400 | Hidden free money! Not in slip but in your PF account. |

| Real “Earnings” | ≈38,600 | What you actually earned this month |

Your 5-Point Salary Slip Action Plan

This Weekend, Do These 5 Things:

- Open Your Latest Slip: Actually download and look at it.

- Check PF Balance: Login to EPFO portal (UMANG app) to see your total PF + employer contribution growing.

- Collect & Submit: Gather all rent receipts, insurance premium proofs, and submit to HR if you haven’t.

- Review Declarations: Check if your HRA, LTA declarations match actual expenses. Update if needed.

- Calculate Your “Real” Salary: Basic + All Allowances + Employer PF = Your true monthly earning.

Common Salary Slip Mistakes That Cost You Money

❌ Not submitting HRA proofs → Paying extra tax unnecessarily

❌ Ignoring PF statements → Missing errors in employer contributions

❌ Under-declaring investments → Large tax deduction at source

❌ Not using food coupons → Losing ₹2,600/month tax-free benefit

❌ Forgetting about LTA → Missing free vacation money every 2 years

The Big Picture: Your Salary Slip is Your Financial Mirror

That piece of paper tells you:

- Are you saving enough for retirement? (PF adequacy)

- Are you optimizing taxes? (HRA, 80C declarations)

- What’s your true worth? (CTC + benefits)

- How secure are you? (Insurance coverage)

Remember: Your “take-home” is not your “available-to-spend.” First account for your forced savings (PF), then plan your 50/30/20 budget from what remains.

What’s Next? Now that you know where your money comes from, our next post will tackle “Where Should It Go? Creating Your First Budget That Actually Works.“

Confused about any line item in your slip? Share (hide personal info) in the comments below! Let’s decode it together.

Share this with your colleague who also just glances at the net pay. Knowledge shared is empowerment multiplied.

P.S. Bookmark this page and revisit it during your next appraisal. Understanding your salary structure helps you negotiate better—you’ll know what to ask for!

Leave a Reply