The Truth About LIC Returns, Surrender Values, and Whether These Plans Still Make Sense for Modern Indians

Your Agent’s Pitch (2023): “LIC Jeevan Anand gives insurance + investment + guaranteed returns! Three benefits in one!”

The 2026 Reality: ₹50,000/year premium, 20-year policy, maturity value: ₹18 lakhs. Same money in PPF: ₹25 lakhs. Difference: ₹7 lakhs lost.

If you or your parents have LIC policies, or you’re considering buying one because “everyone has it,” this review isn’t about bashing LIC. It’s about informed decisions. Because in 2026, with dozens of better options available, blind tradition costs lakhs.

Part 1: The LIC Numbers Don’t Lie

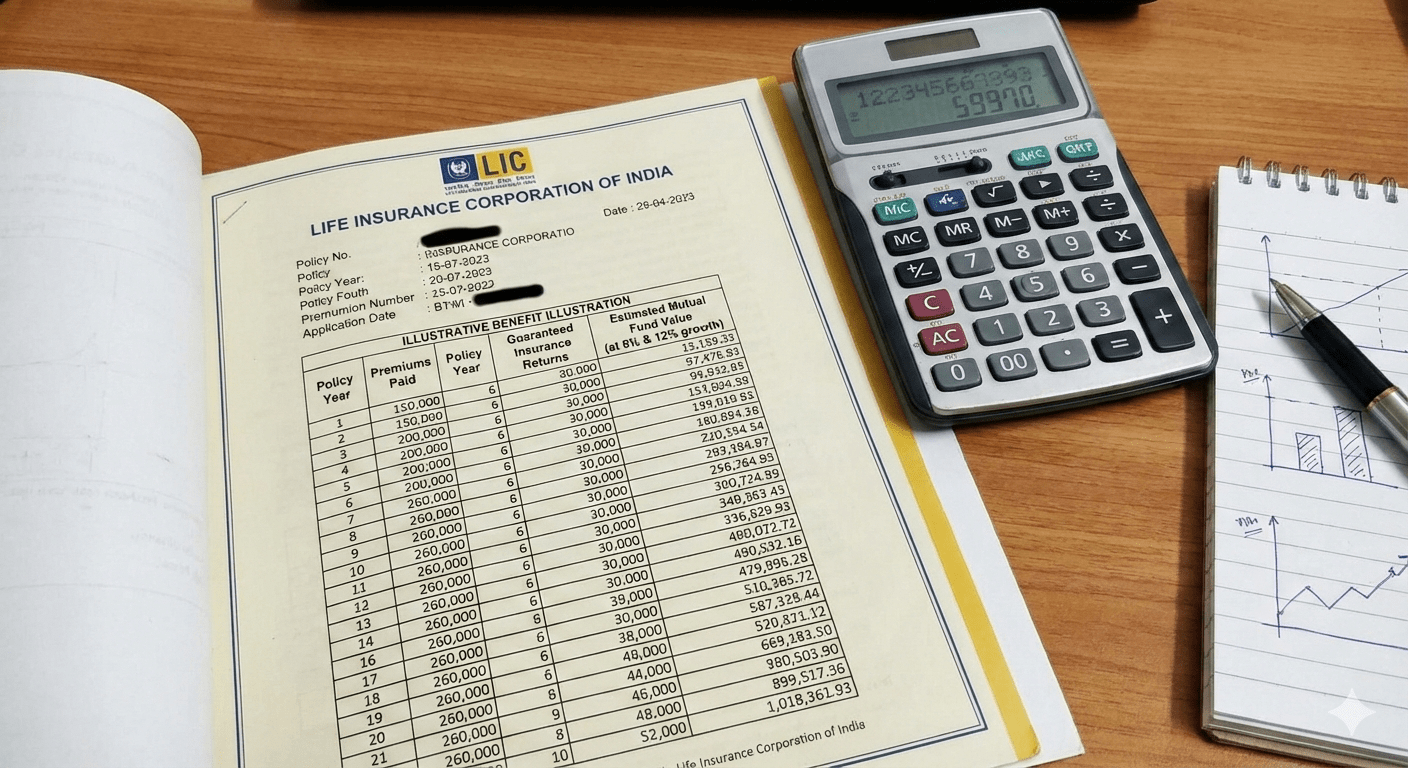

Jeevan Anand (Table 845) – The Most Sold Policy:

Premium: ₹50,000/year (Age 30) Term: 20 years Total Premium Paid: ₹10 lakhs Sum Assured: ₹15 lakhs Bonus (approx): ₹8 lakhs **Maturity Value: ₹18 lakhs**

Effective Return: 5.2-5.8% annually (pre-tax)

Compare With:

- PPF: ₹10 lakhs → ₹23 lakhs (7.1% tax-free)

- Debt Fund: ₹10 lakhs → ₹21 lakhs (6.5% post-tax)

- NPS: ₹10 lakhs → ₹22 lakhs (8% approx)

The Insurance Cost: Out of ₹50,000 premium, only ₹5,000-₹8,000 is actual insurance. Rest is “investment” giving 5-6% returns.

Part 2: The 3 Types of LIC Policies Decoded

Type 1: Endowment Plans (Jeevan Anand, Jeevan Labh)

What: Insurance + Savings

Returns: 5-6% pre-tax

Good For: Ultra-risk-averse, forced savings

Not For: Wealth creation, optimal returns

Type 2: Money Back Plans (Jeevan Umang)

What: Regular payouts + lump sum maturity

Returns: 4-5% (lower due to early payouts)

Use: Creating “income” illusion

Better Alternative: SWP from mutual funds

Type 3: Term Plans (Tech Term, Saral Jeevan Bima)

What: Pure insurance (finally!)

Cost: ₹1 crore cover at 30 = ₹8,000-₹12,000/year

Verdict: Actually good value! (But agents rarely sell these)

Part 3: The Surrender Value Trap

The Painful Math:

Policy Year 5: Want to surrender?

- Premiums paid: ₹2.5 lakhs

- Guaranteed surrender value: ₹1.1 lakhs (45% loss)

- Special surrender value: ₹1.4 lakhs (44% loss)

Why Such Loss? High first-year commissions (30-40% of first premium) recovered from early surrenders.

Rule: Never buy LIC if you might need money before 10 years.

Part 4: LIC vs Modern Alternatives (2026 Comparison)

| Aspect | LIC Endowment | Term + Mutual Funds | Winner |

|---|---|---|---|

| ₹50k/year, 20 years | ₹18 lakhs | ₹35-45 lakhs | Term+MF |

| Insurance Cover | ₹15 lakhs | ₹1 crore+ | Term+MF |

| Flexibility | Locked 10-20 years | Withdraw anytime | Term+MF |

| Transparency | Complex bonuses | Clear NAVs | Term+MF |

| Tax Efficiency | Maturity tax-free | LTCG tax applies | LIC |

| Emotional Security | “LIC won’t fail” | Market fluctuations | LIC |

The Hybrid Approach: ₹8,000 for term insurance + ₹42,000 in mutual funds = Better returns + Better coverage.

Part 5: Who Should Still Consider LIC in 2026?

Scenario 1: The Financial Novice

- Can’t resist spending if money is accessible

- Needs forced savings mechanism

- Solution: LIC works as “better than nothing”

Scenario 2: The Parent’s Wish

- Parents insisting, family harmony important

- Already maxed out other investments

- Compromise: Minimum LIC policy + real investments

Scenario 3: Government Employee with Perks

- LIC agents in office, convenient payments

- Group discounts sometimes available

- Check: Compare with NPS/PPF first

Scenario 4: The Bonus Seeker

- Expecting LIC’s “7th Pay Commission” type bonuses

- Betting on government support

- Reality: Bonuses declining yearly (4% in 2026 vs 10% in 2000)

Part 6: The LIC Loan Advantage – The Hidden Benefit

Policy Loan Features:

- Rate: 9-10% (better than personal loan’s 12-18%)

- Amount: Up to 90% of surrender value

- Processing: 2-3 days, minimal documents

- No CIBIL Impact: If repaid properly

Smart Strategy:

Keep one paid-up LIC policy specifically for emergency loans.

Example: ₹5 lakh surrender value = ₹4.5 lakh emergency loan at 9.5% within 72 hours.

Part 7: The Tax Angle – Not What You Think

Section 80C Benefit:

Both LIC and ELSS get same deduction. But:

- LIC: Locks money 15-20 years for 5-6% returns

- ELSS: Locks 3 years for 10-12% returns

- Winner: ELSS for anyone under 50

Section 10(10D) – The “Tax-Free” Maturity:

Myth: All LIC proceeds tax-free

Reality: Only if premium ≤ 10% of sum assured

Example: ₹50,000 premium needs ₹5 lakh+ sum assured for tax-free status

Part 8: Existing Policy Holders – What to Do?

If Policy is <3 Years Old:

- Surrender: 45-60% loss immediate

- Continue: Better if you’ll complete term

- Make Paid-up: Stop premiums, reduced benefits

If Policy is 5-10 Years Old:

- Check paid-up value: Usually better than surrender

- Consider loan against policy if need funds

- Continue if less than 5 years remaining

If Policy is >10 Years Old:

- Almost always continue – most losses already absorbed

- Use maturity for debt repayment or child’s education

- Don’t reinvest in new LIC policy

Part 9: The 2026 Buying Checklist (If You Must Buy)

Only Buy LIC If:

- Already maxed out PPF, NPS, EPF

- Have term insurance separately

- Have equity investments separately

- Need forced savings mechanism

- Buying minimal amount (₹25-50k/year)

- For emotional/family reasons

Never Buy LIC If:

- This is your only investment

- You don’t have term insurance

- You might need money before 10 years

- You’re under 35 and can take some risk

- Agent is pressuring with “limited period offer”

Part 10: The Modern Alternative Formula

The 2026 Smart Mix:

For ₹50,000/year savings:

- Term Insurance (₹8,000): ₹1 crore cover (LIC Tech Term or HDFC/ICICI)

- ELSS (₹18,000): Tax saving + growth (3-year lock-in)

- PPF (₹15,000): Safe, tax-free returns

- NPS (₹9,000): Extra ₹50k deduction + pension

Result: Better insurance + Better returns + Flexibility

Download our free “LIC vs Alternatives Calculator” – Compare exact returns, surrender values, and opportunity costs.

Share your LIC experience anonymously: Policy name, premiums, returns – help others learn! 👇

Leave a Reply