Don’t Wait Till March – This December Checklist Could Save You ₹50,000+ in Taxes AND Improve Your Financial Health.

Scene 1: March 28, 2026. Rohan is frantically calling his agent: “Bhaiya, ₹1.5 lakh invest karana hai, 3 din mein! Koi bhi scheme bata do!” He invests in the first plan shown, pays extra commission, and gets subpar returns.

Scene 2: Same Rohan, but today – December 2025. He calmly reviews this checklist, makes strategic decisions over 3 months, saves ₹47,000 in tax, AND gets better investment returns.

The difference? 97 days of planning vs 3 days of panic.

If you’re an Indian earning more than ₹7 lakhs/year, this December could save you ₹20,000-₹50,000 in unnecessary tax payments next year. More importantly, it could prevent you from making ₹2-5 lakh worth of bad financial decisions in March madness.

Grab your coffee and 30 minutes. Let’s build your December Tax Action Plan together.

Part 1: The 3 Tax Personalities – Which One Are You?

Type 1: The March Madness Maker (80% of Indians)

- Action: Last-week panic investing

- Result: Wrong products, high commissions, poor returns

- Tax Saving: Yes, but wealth destruction: ₹1 lakh investment → ₹85,000 value in 3 years

Type 2: The January Planner (15% of Indians)

- Action: January planning, February-March execution

- Result: Better choices, but limited time for research

- Tax Saving: Good, wealth preservation: ₹1 lakh → ₹1.1 lakh in 3 years

Type 3: The December Strategist (5% of Smart Indians)

- Action: December planning, spreading investments Jan-Mar

- Result: Best products, cost averaging, optimal returns

- Tax Saving: Excellent, wealth creation: ₹1 lakh → ₹1.3 lakh+ in 3 years

This post will help you become Type 3. The goal isn’t just tax saving – it’s tax-efficient wealth building.

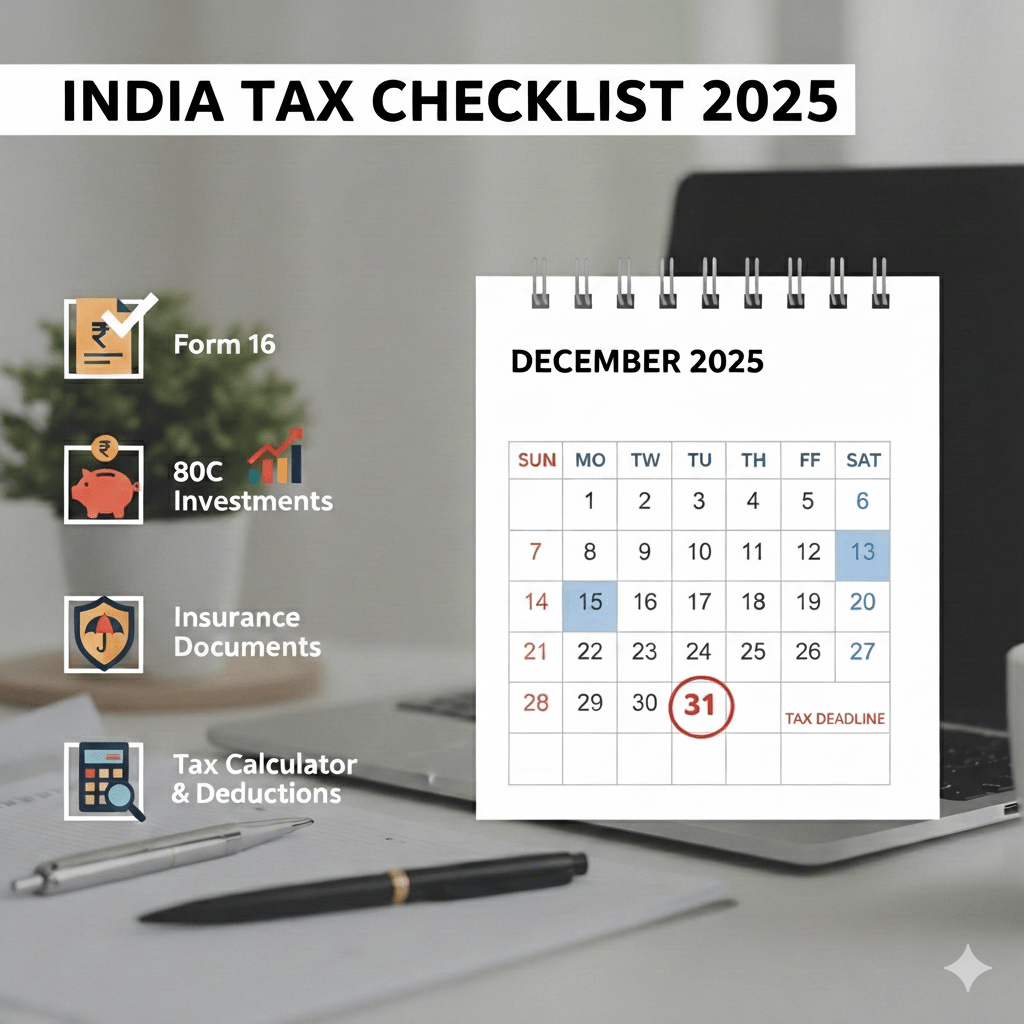

Part 2: Your December Tax Checklist (10 Action Items)

✅ CHECK 1: Calculate Your Exact Tax Liability TODAY

Why: You can’t plan what you don’t measure.

How to Calculate:

- Gross Salary: Check December payslip

- Existing Deductions: HRA, LTA, Standard Deduction already considered

- 80C Investments Already Made: PF, life insurance premiums, etc.

- Other Investments: 80D (health), 80CCD(1B) (NPS), etc.

Simple Formula:

Taxable Income = Gross Income - (Standard Deduction + HRA + LTA + Already claimed deductions) Remaining 80C Space = ₹1,50,000 - (PF + Insurance + Other 80C investments) Tax Liability = Calculate using new/old regime calculator

Action: Use any online income tax calculator.

✅ CHECK 2: New Regime vs Old Regime – FINAL Decision

Critical: This choice affects ALL other decisions.

New Regime Wins If:

- Your total 80C+80D+other deductions < ₹3.75 lakhs

- You have simple income (mostly salary, minimal deductions)

- You’re under 40 with fewer liabilities

Old Regime Wins If:

- You have home loan (Section 24 + 80EE benefits)

- You invest regularly in ELSS, PPF, insurance

- Your total deductions > ₹4 lakhs

- You have family health insurance (80D)

December Action:

- Calculate tax under BOTH regimes

- Choose ONE and stick with it for entire FY

- Inform employer NOW for correct TDS

✅ CHECK 3: Home Loan Interest Certificate

Deadline: Request by December 31 from bank.

Why: Section 24 (up to ₹2 lakh interest deduction) + Section 80EEA (extra ₹1.5 lakh for first-time buyers).

Documents Needed:

- Loan statement (April 2025 – March 2026 projected)

- Interest certificate (will come in January)

- Principal repayment proof (for 80C)

Action This Week:

- Email bank: “Please send interest certificate for FY 2025-26”

- Mark calendar: Follow up on January 15 if not received

✅ CHECK 4: Health Insurance Review & Top-up

Section 80D Benefits:

- Self/Family: ₹25,000 (under 60) / ₹50,000 (senior)

- Parents: ₹25,000/₹50,000 extra

- Total possible: ₹1,00,000 deduction

December Actions:

- Check existing coverage: Is it enough post-COVID? (Minimum ₹10 lakh recommended)

- Top-up if needed: Super top-up plans are cost-effective

- Parents’ insurance: Renew or purchase before March 31

- Preventive health checkup: ₹5,000 deduction (within above limits)

Pro Tip: Buy 2-year policies in December – often cheaper, and you lock in next year’s deduction too.

✅ CHECK 5: NPS – The ₹50,000 Bonus Deduction

Section 80CCD(1B): Extra ₹50,000 beyond 80C’s ₹1.5 lakh.

Who Should Consider:

- Already maxing 80C

- Age 35+ thinking about retirement

- Want extra tax saving with decent returns

December Action:

- Open NPS account if don’t have (via bank or online)

- Decide allocation: 50% equity if under 45, more debt if older

- Set up SIP: ₹4,167/month to reach ₹50,000 by March

- Don’t forget: This is locked till 60 (withdraw 60% tax-free)

✅ CHECK 6: Document Collection Marathon

Create These 3 Folders NOW:

Folder 1: Investment Proofs

- PPF passbook/statement

- ELSS mutual fund statements

- Life insurance premium receipts

- NSC certificates

- School tuition fees receipts (children)

Folder 2: Expense Proofs

- Rent receipts (with owner’s PAN if rent > ₹1 lakh/year)

- Home loan interest certificate

- Medical bills (for reimbursement claims)

- Charity donation receipts (80G)

Folder 3: Income Documents

- Form 16 (will come in April/June)

- Interest certificates from banks

- Capital gains statements

- Freelance income receipts

December Goal: Have 70% documents ready by December 31.

✅ CHECK 7: Capital Gains Planning

Scenario: You sold stocks/property in 2025.

December Actions:

- Calculate gains: Short-term vs long-term

- Set aside tax money: Don’t spend it thinking “I’ll manage later”

- Consider tax-saving bonds: 54EC bonds for property gains (save tax if invested within 6 months)

- Harvest losses: If you have loss-making investments, consider selling to offset gains

Important Dates:

- Property sale: Invest in 54EC bonds within 6 months of sale

- Equity sale: Pay advance tax by December 15 if liability > ₹10,000

✅ CHECK 8: Advance Tax Check

Who Pays Advance Tax:

- If tax liability > ₹10,000 after TDS

- Freelancers, business owners, landlords

- People with capital gains, interest income

December 15 Deadline: 3rd installment (75% of total tax)

Action:

- Calculate total expected income

- Subtract TDS already deducted

- Pay balance if > ₹10,000

- Use Challan 280 on income tax portal

Penalty: 1% monthly interest on unpaid advance tax. Don’t ignore!

✅ CHECK 9: Tax-Saving Investments – Smart Allocation

The December Strategy: Plan now, execute Jan-Mar.

Optimal 80C Allocation for Middle-Class:

- PF/VPF: Already happening, check if you can increase

- ELSS: 40-60% of remaining amount (start SIP in January)

- PPF: 20-30% (lump sum in March for compounding)

- Life Insurance: Only if you need coverage (not just for tax)

- Home Loan Principal: Already paid, get certificate

Golden Rule: Never buy insurance just for tax saving. Buy term insurance for protection, invest separately.

✅ CHECK 10: Family Finance Meeting

Last Sunday of December: 2-hour family meeting.

Agenda:

- Review checklist progress

- Assign responsibilities:

- Who collects which documents?

- Who follows up with bank/agent?

- Who maintains the folders?

- Set January 15 review date

- Celebrate completing the checklist!

Why Family? Because tax decisions affect everyone. Wife’s investments, children’s tuition fees, parents’ insurance – it’s all connected.

Part 3: The Month-by-Month Execution Plan

December (Planning Month):

- Week 1: Complete checks 1-5

- Week 2: Document collection starts

- Week 3: Make final decisions (regime, investments)

- Week 4: Family meeting, finalize plan

January (Action Month):

- Start ELSS SIP (better averaging than lump sum)

- Pay Q3 advance tax (if applicable)

- Follow up on pending documents

- Book preventive health checkup

February (Consolidation Month):

- Review investment progress

- Make PPF contribution

- Pay children’s tuition fees

- Complete health insurance purchases

March (Completion Month):

- Week 1: Final review

- Week 2: Make remaining investments

- Week 3: Submit proofs to employer (if possible)

- Week 4: Relax – you’re done!

Part 4: Common December Mistakes & How to Avoid

❌ Mistake 1: Buying Insurance for Tax Saving

Problem: ULIPs/endowment plans give 4-5% returns, charge 5-10% fees

Solution: Buy term insurance (if you need protection), invest in ELSS/PPF separately

❌ Mistake 2: Last-Minute ELSS Lump Sum

Problem: Investing ₹1.5 lakh on March 31 = no averaging, higher risk

Solution: Start ₹50,000 SIP in January across 3 months

❌ Mistake 3: Ignoring Home Loan Benefits

Problem: Not claiming Section 24 (₹2 lakh) + 80EEA (₹1.5 lakh extra)

Solution: Get interest certificate early, claim correctly

❌ Mistake 4: Wrong Regime Choice

Problem: Choosing new regime but having ₹4+ lakh deductions

Solution: Calculate both, choose wisely, stick to it

❌ Mistake 5: Not Informing Employer

Problem: High TDS deduction, refund wait

Solution: Submit investment declarations by January 31

Part 5: Special Cases

For Freelancers/Business Owners:

- Maintain books properly from Day 1

- Pay advance tax by December 15 (75%)

- Claim expenses legitimately (office, travel, phone)

- Consider presumptive taxation if turnover < ₹50 lakhs (44ADA)

For Senior Citizens:

- Higher 80D limit: ₹50,000 for self, ₹50,000 for spouse

- Senior Citizen FD: Extra 0.5% interest, but taxable

- Pension income: Standard deduction ₹50,000

- Medical expenses: Deduction for specific treatments

For Women Taxpayers:

- No extra benefits anymore (gender-neutral now)

- But: Plan jointly with husband for optimal family savings

- Important: File returns independently if income > basic exemption

For NRIs:

- Residential status matters (182 days rule)

- Different tax rates for Indian vs foreign income

- DTAA benefits: Avoid double taxation

- March 31 deadline same for everyone

Part 6: Your December Action Kit

Free Resources:

- Tax Calculator Google Sheet (Link below)

- Document Checklist PDF

- Month-by-Month Planner

- Regime Comparison Calculator

Apps to Help:

- Quicko/ClearTax: For calculations

- Google Keep/Evernote: Document tracking

- Calendar reminders: For deadlines

- Banking apps: For interest certificates

Professional Help When Needed:

- Hire CA if: Business income, capital gains > ₹10 lakh, foreign income

- Cost: ₹2,000-₹10,000 (saves headaches and penalties)

- Find: Through references, not random ads

Part 7: The December Pledge

Copy, paste in comments, and commit:

I, [Your Name], pledge to complete my tax planning in December 2025. I will: 1. Calculate my exact tax liability by December 25 2. Choose the right tax regime by December 31 3. Collect 70% of my documents by December 31 4. Make smart investment decisions, not panicked ones 5. Involve my family in the process I understand that: "Early planning saves money AND stress. Smart tax planning is wealth planning. March is for execution, December is for strategy." Signed, [Your Name] December 2025

Your This-Weekend Action Plan:

Saturday (3 hours):

- Hour 1: Calculate tax liability (Check 1)

- Hour 2: Decide tax regime (Check 2)

- Hour 3: Request home loan certificate & review insurance (Checks 3-4)

Sunday (2 hours):

- Hour 1: Start document collection (Check 6)

- Hour 2: Family meeting to assign tasks (Check 10)

Result: By Sunday night, you’ll be ahead of 90% of Indians in tax planning.

Questions? Confusions?

Ask in comments below! Our community and I will help with:

- Specific calculation problems

- Document confusion

- Investment choices

- Regime decisions

Pro Tip: Sort comments by “Newest” – answer someone else’s question. Teaching is the best way to learn!

Bookmark this page – return to it every weekend in December to track progress.

Share with 3 friends who also do March madness planning – save them money and stress!

Leave a Reply